On the occasion of its I/O 2022 conference, Google has just unveiled “Virtual Cards”, a service generating a temporary card number to allow you to pay online without communicating your real details. Only Google knows the real numbers.

Let’s be honest, we all feel a bit scared when a site asks us for our banking information. While services provide protection (PayPal, Apple Pay, Google Pay, etc.), there are still many e-commerce platforms that require your payment card numbers to place an order. In view of the proliferation of fraud and all that we can hear everywhere, it is not uncommon to be afraid. Are we going to be hacked by entering our contact details? Is the site real? How to oppose in case of problem? The questions are many.

Some banks respond to this problem with a so-called “e-credit card” system. Generally charged a little over 10 euros per year (or included in bank charges), it allows you to go to a site to generate a unique bank card valid only for a specific amount. In case of hacking, the cybercriminal cannot do anything, the card does not work. It just so happens that this service inspired Google which, at its I/O developer conferenceannouncement Virtual Cardsits own competitor of the e-credit card.

Virtual Cards can change everything

In our view, Virtual Cards is not just a competitor to virtual bank cards. Why ? Quite simply because it is integrated into Google Chrome, the most used browser on the planet, and therefore almost transparent for users.

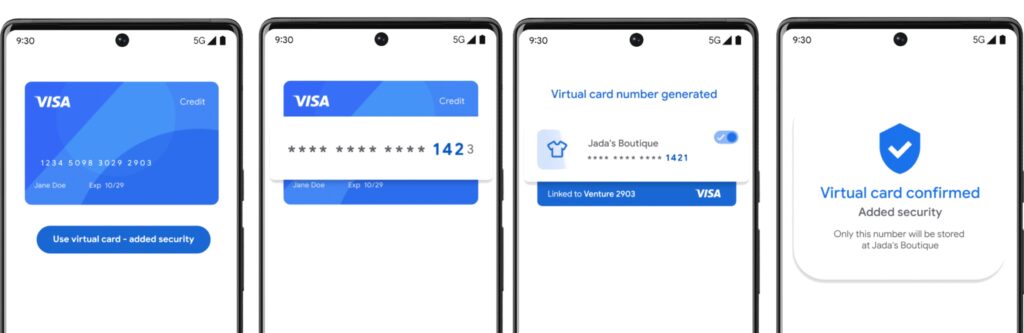

Let’s take the example of the Caisse d’Epargne service which forces its customer to identify himself on a special site and fill out a form to generate a false provisional card. This is not at all practical, especially since you then have to copy and paste the coordinates manually. Google will make the generation of a fake card simple, automatic and free. There is nothing to do except click a button.

Concretely, when a site asks you for your bank details, the option “Use a virtual card will appear on the screen”. Google, which will have to register your real bank card beforehand, will display an animation revealing the transformation of the numbers. False coordinates will be sent to the merchant site, but Google will charge you the correct amount. In the end, Google will be your only banking contact. The others will no longer be able to trace you.

Unfortunately, Virtual Cards has one major flaw: it’s only launching in the US at first (like many banking services, the Apple Card can attest). Since all American Visa, American Express and Capital One cards are compatible (the Mastercards will arrive at the end of 2022), one can imagine that Google will be able to easily adapt its service to Europe. In the meantime, that leaves a few months for the banks to improve their system, why not with extensions in the browser?

A hidden way to tax Google Pay?

What surprises us with Virtual Cards is that the service directly overshadows Google Pay, Google’s mobile payment solution, available on all Android smartphones equipped with an NFC chip. As long as the service works with all cards, why bother setting up Google Pay when Virtual Cards will work everywhere?

We questioned Google on the subject which tells us that they want to leave the choice to the user. Once his card is registered for the first time (even if it is not compatible with Google Pay), then it will work with Virtual Cards on all sites. What will Google Pay be used for when Virtual Cards is launched everywhere? Probably contactless payment outside, but that’s about it. Google takes the risk of parasitizing its payment solution but, let’s be honest, it has never had the same success as Apple Pay or PayPal.